How a Dominican Auto Finance Firm Transformed Risk into Confidence with Jimi IoT

Industry: Auto Finance

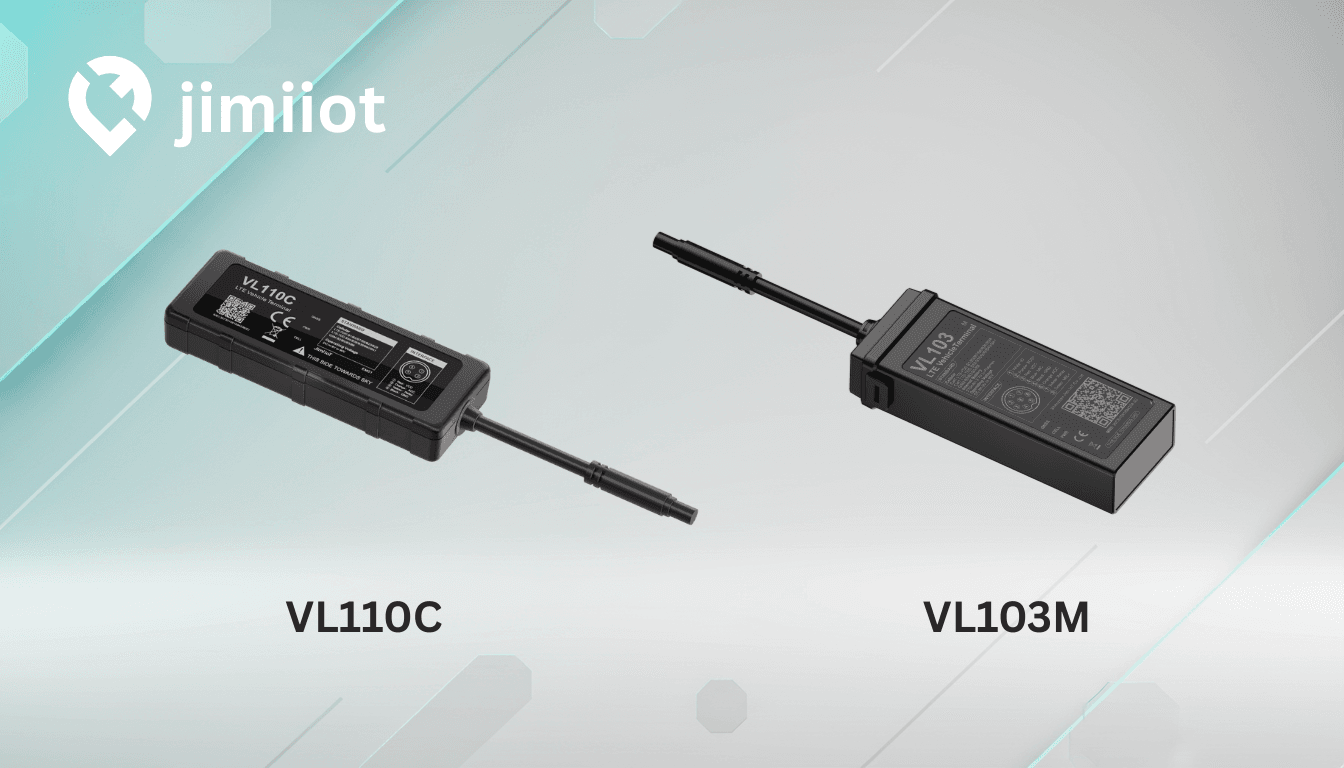

Products: VL103M, VL110, Tracksolid Pro, IoT SIM Cards

Summary

A leading auto finance company in the Dominican Republic, working with the nation’s four largest banks, faced growing risks as financed vehicles disappeared into high-risk areas or were lost to tampering. Conventional tracking lagged behind fast-evolving threats, leaving trust and partnerships exposed.

To regain control, the company deployed Jimi IoT’s VL103M and VL110C trackers powered by IoT SIM cards and Tracksolid Pro platform, enabling real-time monitoring, abnormal activity alerts, and remote fuel and power cutoff, ensuring vehicles could be recovered swiftly and safely.

With these tools, the company has reduced irrecoverable asset loss by 40% and cut recovery times by over 60%. Beyond numbers, stronger trust now fuels expanded lending zones, faster loan approvals, and deeper confidence from partner banks.

1. The Disappearing SUV

It started with a dot.

One dot. Frozen on the edge of a border town in Dajabón.

The SUV wasn’t supposed to be there. And it wasn’t supposed to stop.

But it had. For six hours. No movement. No check-ins. No calls answered.

The borrower had gone dark.

The car had gone still.

The map stopped changing.

Inside the control room, no one spoke at first. They’d seen this before. They just hoped this wasn’t that.

“Could be signal loss,” someone offered.

No one replied.

The tracker was silent. No flicker. No update. Just a frozen dot on a fading screen.

A $25,000 vehicle. A loan with three months left.

And no way to know where it went. Or how fast. Or who was driving now.

Cars vanish into underground markets faster than paperwork can catch up. And silence? It’s more than a technical glitch.

It’s the sound of losing control.

And for the finance firm—already juggling rising defaults, complex recovery ops, and watchful partner banks—it wasn’t just one car.

It was a warning. And every ounce of trust suddenly on the line.

2. Extending Trust, Not Just Credit

As one of the Dominican Republic’s most prominent auto finance companies, the firm operates at the crossroads of aspiration and accountability. Working closely with the country’s four largest banks, they offer accessible vehicle loans to many Dominicans.

Their borrowers range from young freelancers, to delivery drivers, small business owners, and first-time car buyers. For banks, the company acts as a strategic partner, streamlining risk assessment, loan servicing, and asset protection.

“We’re not just extending credit,” the Head of Lending explained. “We’re extending trust, both to customers and to our partners. That’s why protecting that trust is everything.”

By offering tailored financing and support, the company has helped reshape what vehicle ownership looks like for a generation of Dominicans. But as the team stared at that frozen dot on the map, it was clear: growth brought complexity, and with it, a new layer of risk.

3. Beyond Trust: The Cost of Scale

The SUV in Dajabón was eventually found at a chop shop miles away, stripped for parts, rendered untraceable. The GPS tracker? Disconnected and discarded.

It wasn’t the first time. And it wouldn’t be the last.

These incidents weren’t isolated. They were symptomatic.

As financing volumes surged, so did exposure. The company wasn’t just underwriting loans anymore. It was inheriting operational risk at scale.

"We were seeing more borderline cases slip through," said the Risk Control Manager. "Good people, but harder to monitor. And when something went wrong, we weren’t finding out until days later."

Certain borrowers frequented high-risk areas. Tracker tampering incidents began to spike. By the time the back-office team caught it in reports, it was too late. Prevention had missed its cue.

Sometimes the issues weren’t malicious, just messy. A driver disputed loan terms and claimed he no longer intended to pay. But there was no way to safely intervene, and without real-time insight, the car might have just become another number on the write-off list.

“It was like trying to manage risk in the dark,” the CTO said. “We only realized something was wrong after it was too late.”

These weren’t just isolated issues. They were indicators of a larger reality: without the right tools, trust alone couldn’t scale.

4. A Smarter, Safer Road with Jimi IoT

That shift began when the company deployed Jimi IoT’s VL103M and VL110C vehicle trackers into its financed vehicles, powered by IoT SIM cards and connected through Tracksolid Pro platform.

But it wasn’t just a technology swap. It was a strategic turning point.

One recent morning, an alert pinged at the operations center. A financed SUV —this time also overdue— had just crossed into a restricted zone near the western border. The team tracked its movement in real time through Tracksolid Pro. After a few minutes, the vehicle came to a stop outside a roadside café. That’s when they acted. With the location confirmed and the engine idle, they issued a remote fuel cutoff command.

The engine was disabled before the driver could attempt to leave. Within hours, a local field team secured the vehicle, intact, unharmed, and ready for recovery. And if GNSS or LTE jamming is detected, the system can also trigger an alert and enables the same remote fuel cutoff, ensuring control even under attempted signal interference.

“Tracking the car was just the start,” said the Recovery Lead. “Being able to act fast is what made the difference.”

In another case, a tamper alert triggered when a borrower attempted to remove the device during a payment dispute. The alert didn’t just inform. It enabled immediate outreach. A support agent called, resolved the dispute, and explained payment terms. What could’ve ended in a repossession became a renewed customer relationship.

This wasn't about features. It was about function in motion. Real-world speed. Real-world stakes.

“It’s not just that we can act,” said the CTO. “It’s that we can act fast, precisely, and without confrontation. That changes everything.”

Today, the finance firm isn’t chasing vehicles. They’re managing risk like air traffic controllers: quietly, consistently, and with total visibility.

5. Raising the Bar for Trust in Auto Finance

The results are speaking, both in numbers and in confidence.

The company has seen a 40% drop in irrecoverable asset loss, and recovery time reduced by over 60%. With stronger controls, they’ve unlocked new lending zones once considered too risky. Partner banks are doubling down on collaboration, confident in the transparency and tools backing every loan.

But beyond the numbers, something deeper has shifted.

Responsible borrowers now benefit from faster loan approvals, more flexible repayment options, and access to financing they may not have qualified for before. With risk under control, the company can focus on empowerment, not just enforcement.

“Technology can’t replace human trust,” said the CEO, “but it can protect it. And that’s exactly what Jimi IoT has helped us do.”

A loan puts a car on the road. Trust keeps it moving.

And now, with every mile secured, confidence travels farther than ever.